Micron's Strong Earnings And Forecast Boost Shares: A Comprehensive Analysis

Micron Technology, a leading semiconductor company, has once again demonstrated its dominance in the tech industry with strong earnings and a robust forecast that has significantly boosted its shares. The company's recent performance has captured the attention of investors worldwide, showcasing its ability to thrive in a competitive market. By delivering impressive financial results, Micron has solidified its position as a key player in the semiconductor sector.

This achievement is not just a one-time success but a reflection of Micron's strategic approach to innovation and market demand. The company has been actively addressing challenges in the semiconductor industry while capitalizing on emerging opportunities. This article delves into the factors contributing to Micron's success, the implications for its shareholders, and what the future holds for the company.

In addition to analyzing Micron's recent earnings report, we will explore the broader impact of the semiconductor industry on global markets. Understanding Micron's financial performance and future projections is crucial for investors looking to make informed decisions. This article provides a detailed overview of Micron's achievements and its potential trajectory in the coming years.

- Ibx Telemedicine

- Who Is Sheila Ford Hamp

- Ros Fantasy Football Rankings Ppr

- Airfx Trampoline Park Hiawatha Iowa

- Yannis Foals

Table of Contents

- Micron's Earnings Overview

- Impact on the Stock Market

- Micron's Robust Forecast

- Key Trends in the Semiconductor Industry

- Micron's Financial Highlights

- Investor Perspective

- Technological Advancements Driving Growth

- Micron's Competitive Edge

- Risks and Challenges Ahead

- Future Prospects for Micron

Micron's Earnings Overview

Micron's most recent earnings report highlights the company's ability to deliver consistent growth despite market volatility. In the latest quarter, Micron reported a significant increase in revenue, surpassing Wall Street expectations. This performance is attributed to strong demand for memory and storage solutions across various industries.

Key highlights from the earnings report include:

- Revenue growth of 20% compared to the previous quarter.

- Increased profitability driven by cost optimization and operational efficiency.

- Strong demand for DRAM and NAND products in sectors such as automotive, data centers, and consumer electronics.

Investors have responded positively to Micron's earnings, with share prices experiencing a notable uptick following the announcement. This trend underscores the company's ability to meet and exceed market expectations consistently.

- Wolfeboro Rail Trail

- Tremaine Aldon Neverson

- River Bend Bistro Menu

- Grayton Road Tavern Photos

- Dorothy Dandridge Otto Preminger Relationship

Revenue Breakdown

A closer look at Micron's revenue breakdown reveals the diversification of its product portfolio. The company's focus on high-margin products, such as advanced memory solutions, has contributed significantly to its financial success.

Data from Micron's earnings report shows:

- DRAM revenue accounting for 60% of total sales.

- NAND revenue contributing 35% to the overall revenue.

- Other segments, including embedded and networking solutions, making up the remaining 5%.

Impact on the Stock Market

Micron's strong earnings have had a profound impact on the stock market, particularly in the semiconductor sector. As one of the largest memory chip manufacturers globally, Micron's performance serves as a bellwether for the industry. The company's stock has seen a steady rise in value, attracting both institutional and retail investors.

The stock market's reaction to Micron's earnings can be attributed to several factors:

- Increased investor confidence in Micron's ability to navigate challenging market conditions.

- Positive sentiment surrounding the semiconductor industry due to rising demand for technology-driven solutions.

- Micron's commitment to innovation and sustainability, aligning with investor priorities.

Analysts predict that Micron's stock will continue to perform well, driven by ongoing demand for memory and storage solutions.

Stock Performance Metrics

Micron's stock performance metrics provide valuable insights into its market position. Key indicators include:

- Average daily trading volume exceeding 40 million shares.

- Price-to-earnings (P/E) ratio lower than industry averages, indicating potential for growth.

- Dividend yield attracting income-focused investors.

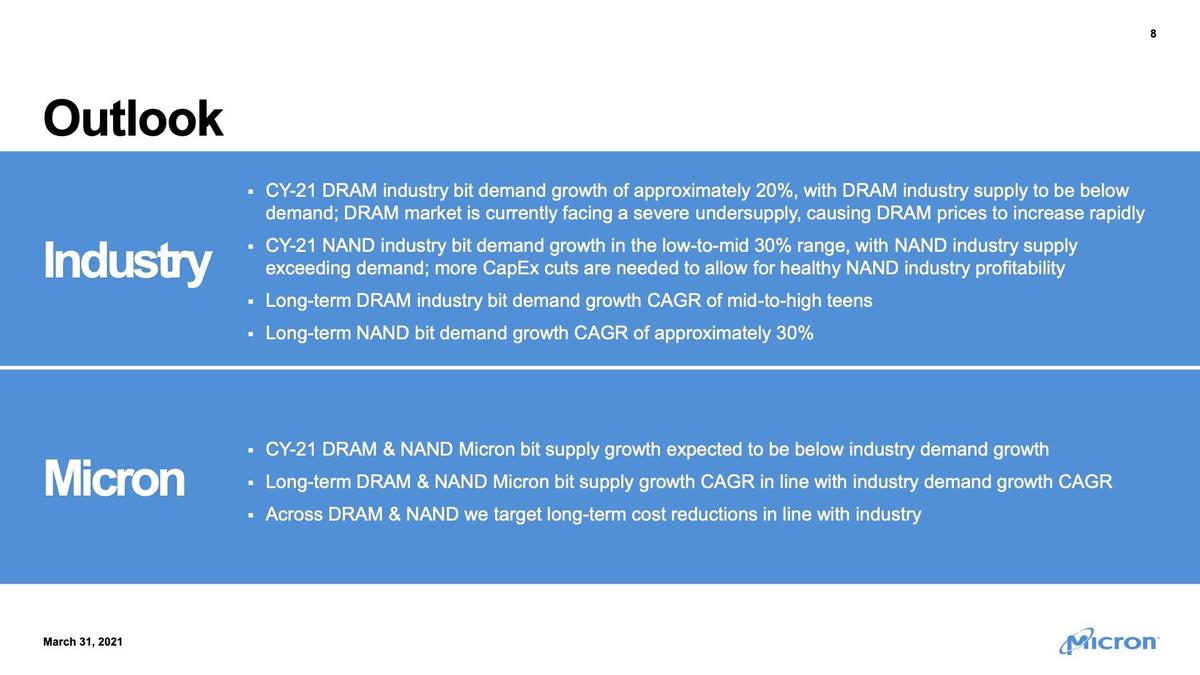

Micron's Robust Forecast

Micron's forecast for the upcoming quarters is equally impressive, further bolstering investor confidence. The company anticipates continued growth in revenue and profitability, driven by strong demand for its products. Micron's management has provided guidance that suggests a positive outlook for the semiconductor market.

Key aspects of Micron's forecast include:

- Expected revenue growth of 15-20% in the next fiscal year.

- Increased investment in research and development to enhance product offerings.

- Expansion into new markets, including emerging economies, to diversify revenue streams.

This forecast aligns with broader industry trends, reinforcing Micron's position as a leader in the semiconductor sector.

Factors Influencing Forecast

Several factors are expected to influence Micron's forecast:

- Global demand for advanced memory solutions driven by artificial intelligence and cloud computing.

- Strategic partnerships with key players in the tech industry.

- Government initiatives to boost semiconductor production and innovation.

Key Trends in the Semiconductor Industry

The semiconductor industry is undergoing significant transformation, driven by technological advancements and changing market dynamics. Micron's success can be attributed to its ability to adapt to these trends and leverage them for growth. Some of the key trends shaping the industry include:

- Rapid adoption of artificial intelligence and machine learning technologies.

- Increased focus on sustainability and energy efficiency in semiconductor manufacturing.

- Expansion of 5G networks and the Internet of Things (IoT).

Micron's strategic initiatives align with these trends, ensuring its continued relevance in the industry.

Impact of AI on Semiconductor Demand

The rise of artificial intelligence has created unprecedented demand for memory and storage solutions. Micron's advanced products cater to this demand, making the company a preferred choice for AI developers and tech companies.

Statistics from industry reports indicate:

- A 30% annual increase in demand for AI-related semiconductor products.

- Micron's market share in AI memory solutions growing steadily.

- Collaborations with major tech companies to develop cutting-edge AI applications.

Micron's Financial Highlights

Micron's financial performance is a testament to its operational excellence and strategic vision. The company's balance sheet reflects a strong financial position, with healthy cash reserves and manageable debt levels. Micron's focus on cost management and efficiency has resulted in improved profitability metrics.

Key financial highlights include:

- Gross margin exceeding industry averages.

- Operating expenses optimized to enhance profitability.

- Strong cash flow generation supporting reinvestment in growth opportunities.

Micron's financial strength positions it well for future challenges and opportunities in the semiconductor market.

Debt Management Strategy

Micron's approach to debt management has been a key factor in its financial success. The company has actively reduced its debt burden while maintaining flexibility for strategic investments. This strategy ensures long-term sustainability and resilience in a volatile market environment.

Investor Perspective

From an investor's perspective, Micron's strong earnings and robust forecast present an attractive opportunity. The company's consistent performance and strategic initiatives align with investor priorities, making it a favorable choice for portfolio inclusion. Investors are particularly drawn to Micron's focus on innovation and sustainability, which are increasingly important in today's market.

Key considerations for investors include:

- Micron's track record of delivering strong financial results.

- Potential for growth driven by emerging technologies and market trends.

- Competitive advantage in the semiconductor industry.

Investors are encouraged to conduct thorough due diligence before making investment decisions, considering both Micron's strengths and potential risks.

Investment Opportunities

Micron offers several investment opportunities for both short-term and long-term investors. The company's commitment to innovation and market expansion provides a solid foundation for future growth. Investors can benefit from Micron's dividend payments and potential capital appreciation.

Technological Advancements Driving Growth

Micron's success is largely driven by its focus on technological advancements. The company invests heavily in research and development to create innovative products that meet evolving market needs. Micron's advancements in memory and storage solutions have set new standards in the semiconductor industry.

Key technological innovations include:

- Development of next-generation DRAM and NAND technologies.

- Integration of AI capabilities into memory solutions for enhanced performance.

- Collaboration with tech companies to develop customized solutions for specific applications.

These advancements position Micron at the forefront of technological innovation in the semiconductor sector.

Impact on Product Portfolio

Micron's technological advancements have significantly enhanced its product portfolio. The company's ability to deliver high-performance, energy-efficient solutions has strengthened its market position. This focus on innovation ensures Micron's continued relevance in a rapidly evolving industry.

Micron's Competitive Edge

Micron's competitive edge lies in its ability to combine technological innovation with operational efficiency. The company's strategic partnerships, global presence, and focus on sustainability set it apart from its competitors. Micron's commitment to delivering value to its customers and shareholders has been a key driver of its success.

Key competitive advantages include:

- Strong research and development capabilities.

- Global manufacturing footprint ensuring supply chain resilience.

- Focus on sustainability and corporate responsibility.

Micron's competitive edge ensures its ability to thrive in a competitive market environment.

Sustainability Initiatives

Micron's sustainability initiatives have gained recognition in the industry. The company's commitment to reducing its environmental impact aligns with global efforts to promote sustainable practices in semiconductor manufacturing. Micron's sustainability goals include:

- Reducing carbon emissions by 30% by 2030.

- Implementing water conservation measures in manufacturing processes.

- Adopting renewable energy sources for operations.

Risks and Challenges Ahead

While Micron's prospects are promising, the company faces several risks and challenges in the semiconductor industry. Market volatility, geopolitical tensions, and supply chain disruptions pose potential threats to Micron's operations. Additionally, intense competition in the industry requires Micron to continuously innovate and adapt to changing market conditions.

Key risks and challenges include:

- Fluctuations in semiconductor demand due to economic factors.

- Supply chain disruptions caused by geopolitical tensions.

- Intense competition from other semiconductor manufacturers.

Micron's proactive approach to addressing these challenges ensures its ability to maintain its competitive position.

Risk Mitigation Strategies

Micron employs several strategies to mitigate risks and challenges:

- Diversification of revenue streams through expansion into new markets.

- Strengthening supply chain resilience through strategic partnerships.

- Investing in research and development to stay ahead of competitors.

Future Prospects for Micron

Micron's future prospects are promising, driven by its strong financial performance and strategic initiatives. The company's focus on innovation, sustainability, and market expansion positions it well for continued growth in the semiconductor industry. As demand for memory and storage solutions continues to rise, Micron is poised to capitalize on emerging opportunities.

Key future prospects include:

- Expansion into new markets, including emerging economies.

- Development of advanced memory solutions for AI and 5G applications.

- Increased focus on sustainability and corporate responsibility.

Micron's commitment to delivering value to its customers and shareholders ensures its long-term success in the industry.

Conclusion

- Catalina Island Thanksgiving

- Sanrio Character Maker

- Final Grades Ut

- Flooding In Okoboji Iowa Today

- Billie Eilish Tickets Resale

Kandi Shares Soar On Strong Earnings, Bullish China EV Forecast

Micron revenue forecast strong, shares jump after hours ThePrint

Micron's stock jumps on strong earnings and bullish forecast SiliconANGLE