IRS Error Blocks $11k Tax Refund: Understanding The Issue And How To Resolve It

The Internal Revenue Service (IRS) plays a critical role in managing tax-related matters for millions of Americans. However, errors in processing tax refunds can lead to significant financial setbacks for taxpayers. Recently, an IRS error blocked an $11k tax refund, causing frustration and financial strain for the affected individuals. In this article, we will delve into the details of this issue, explore its causes, and provide actionable solutions.

This problem highlights the importance of understanding how the IRS operates and how taxpayers can protect themselves from similar issues. Whether you're dealing with a small refund or a significant amount like $11,000, it's crucial to be informed about the steps you can take to ensure your refund is processed correctly.

By the end of this article, you will have a comprehensive understanding of IRS errors, their potential impacts, and the steps you can take to resolve them efficiently. Let's begin by exploring the background of this issue and its relevance to taxpayers today.

- Troy Aikman And Lorrie Morgan

- Sunny Hostin Books In Order

- 100 Dollar Bill On Windshield

- Moloaa Bay Kauai

- Clift Farms Apartments Madison Al

Table of Contents

- Overview of IRS Error Blocking Tax Refunds

- Common Causes of IRS Errors

- Impact of IRS Errors on Taxpayers

- Steps to Resolve IRS Errors

- Preventing Future IRS Errors

- Legal Implications and Rights of Taxpayers

- IRS Error Statistics

- Resources for Taxpayers

- Expert Advice on Handling IRS Errors

- Conclusion and Call to Action

Overview of IRS Error Blocking Tax Refunds

Understanding the IRS Error

An IRS error blocking $11k tax refund is not an isolated incident. The IRS processes millions of tax returns annually, and while the system is designed to be efficient, errors can occur. These errors may stem from manual processing mistakes, software glitches, or mismatches in taxpayer information.

The IRS uses a complex system to verify taxpayer data, including income, deductions, and credits. If any discrepancy is detected, the refund may be delayed or blocked until the issue is resolved. For taxpayers expecting a refund, especially a significant one like $11,000, this delay can be financially burdensome.

Common Causes of IRS Errors

Human and Systematic Errors

Several factors contribute to IRS errors, including:

- Vybz Kartel Kids

- Lab Rats Billy Unger

- Does Mcdonald S Have A Grinch Happy Meal

- Heart Evangelista Father

- Restaurants Near Nederlander Theatre Nyc

- Incorrect or incomplete information on tax forms.

- Typographical errors made by taxpayers or IRS employees.

- Software malfunctions during the processing of tax returns.

- Mismatches between the taxpayer's reported income and the information provided by employers or financial institutions.

These errors can lead to delays in processing refunds or even the complete blocking of refunds, as seen in the case of the $11k tax refund issue.

Impact of IRS Errors on Taxpayers

Financial and Emotional Stress

When the IRS blocks a tax refund, it can have a profound impact on taxpayers. For many, tax refunds are a critical source of income used to pay bills, cover unexpected expenses, or save for the future. The blocking of an $11k tax refund, for instance, can cause significant financial strain.

Beyond the financial implications, IRS errors can also lead to emotional stress. Taxpayers may feel frustrated, anxious, or even distrustful of the IRS system. This emotional toll can further complicate the process of resolving the issue.

Steps to Resolve IRS Errors

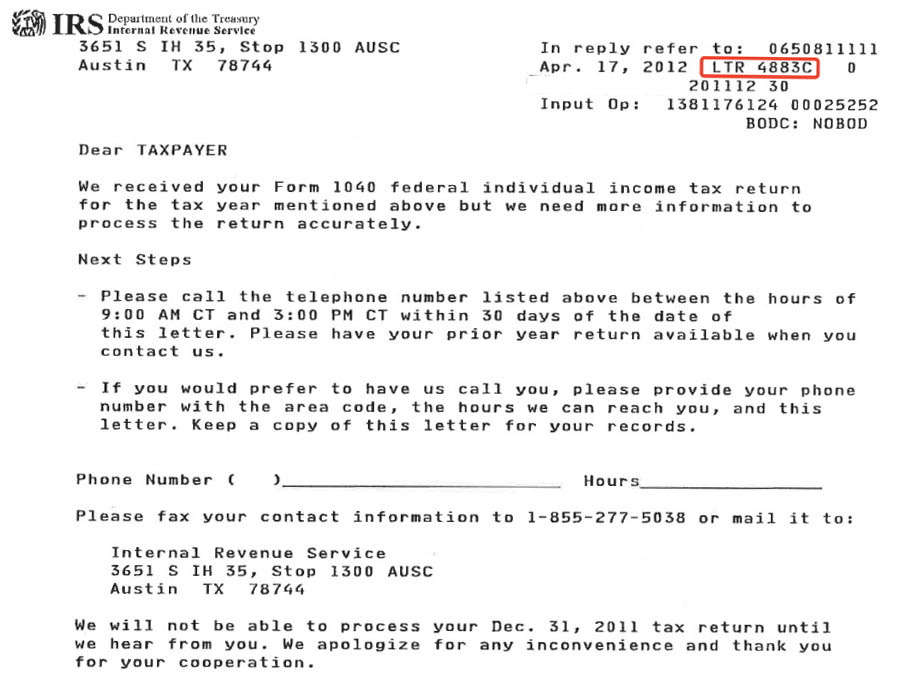

Contacting the IRS

If you encounter an IRS error blocking your tax refund, it's essential to take immediate action. Here are the steps you can follow:

- Review your tax return for any errors or discrepancies.

- Contact the IRS directly using the contact information provided on their official website.

- Provide any additional documentation requested by the IRS to resolve the issue.

Persistence and clear communication are key to resolving IRS errors efficiently.

Preventing Future IRS Errors

Best Practices for Taxpayers

While IRS errors can sometimes be unavoidable, there are steps taxpayers can take to minimize the risk:

- Double-check all information on your tax forms before submission.

- Use tax preparation software to reduce the likelihood of errors.

- Keep detailed records of all tax-related documents.

By adopting these best practices, taxpayers can reduce the chances of encountering IRS errors in the future.

Legal Implications and Rights of Taxpayers

Understanding Your Rights

Taxpayers have certain rights when dealing with the IRS, including the right to be informed, the right to quality service, and the right to appeal an IRS decision. If an IRS error blocks your tax refund, you have the legal right to challenge the decision and request a review.

It's important to familiarize yourself with these rights to ensure you are treated fairly during the resolution process.

IRS Error Statistics

Data and Trends

According to recent data, IRS errors are not uncommon. In 2022, the IRS processed over 250 million tax returns, with approximately 5% experiencing some form of error. While this percentage may seem small, it translates to millions of taxpayers affected annually.

Understanding these statistics can help taxpayers prepare for potential issues and take proactive steps to avoid them.

Resources for Taxpayers

Where to Find Help

Several resources are available to assist taxpayers dealing with IRS errors:

- The IRS official website provides comprehensive information on error resolution and taxpayer rights.

- Tax professionals and accountants can offer expert advice and assistance in resolving IRS issues.

- Non-profit organizations, such as the Taxpayer Advocate Service, provide free support to taxpayers in need.

Utilizing these resources can make the resolution process smoother and more efficient.

Expert Advice on Handling IRS Errors

Insights from Tax Professionals

Tax professionals emphasize the importance of staying calm and organized when dealing with IRS errors. They recommend:

- Documenting all communications with the IRS.

- Seeking professional help if the issue is complex or unresolved.

- Staying informed about IRS policies and procedures.

Expert advice can provide valuable guidance during the resolution process.

Conclusion and Call to Action

In conclusion, IRS errors blocking tax refunds, such as the $11k refund issue, can be frustrating and financially burdensome. However, by understanding the causes of these errors and taking proactive steps, taxpayers can minimize their impact.

We encourage you to share your experiences with IRS errors in the comments section below. Additionally, feel free to explore other articles on our website for more information on tax-related topics. Together, we can build a community of informed taxpayers who are better equipped to handle IRS challenges.

For further reading, consider checking out the following resources:

- Gary Busey Smile

- Gloria Trevi Now

- Elastec Inc

- Vineyard Haven Terminal

- Discount Tire University And Lindsay

Tax Refund Irs Tax Refund Error

How to Check Your IRS Refund Status in 5 Minutes Bench Accounting

IRS Tax Refund r/IRS