IRS Agents Promoted After Biden Probe: A Deep Dive Into The Controversy

The recent promotion of IRS agents involved in the Biden probe has sparked widespread debate and controversy across the United States. This decision has been met with both praise and criticism, as it raises questions about the independence and impartiality of the Internal Revenue Service (IRS). In this article, we will explore the details surrounding this highly publicized event, examining the implications and potential consequences for the agency and the nation.

The IRS, a key federal agency responsible for tax collection and enforcement, has long been a focal point of political scrutiny. The decision to promote agents who played a role in investigating one of the nation's most prominent political figures has reignited discussions about the agency's role in maintaining fairness and transparency in its operations.

This article aims to provide a comprehensive understanding of the situation, offering insights into the background, motivations, and potential ramifications of the decision to promote these agents. By examining the facts and considering expert opinions, we aim to shed light on this complex issue and encourage informed discussions.

Table of Contents

- Background of the IRS and the Biden Probe

- Details of the Agents' Promotion

- Controversy Surrounding the Decision

- Legal Implications of the Promotion

- Public Reaction and Political Ramifications

- Expert Views on the Issue

- Historical Context of IRS Investigations

- Future Direction of the IRS

- Impact on Taxpayers and Public Trust

- Conclusion and Call to Action

Background of the IRS and the Biden Probe

The Internal Revenue Service (IRS) is a crucial component of the U.S. government's financial oversight system. Established in 1862, the IRS is responsible for enforcing tax laws and ensuring compliance among American citizens and businesses. Over the years, the agency has faced numerous challenges, including accusations of bias and political interference.

Role of the IRS in Tax Enforcement

The IRS plays a vital role in maintaining the integrity of the nation's tax system. Its responsibilities include auditing tax returns, collecting unpaid taxes, and investigating potential cases of tax fraud. In recent years, the agency has been under increasing scrutiny, particularly regarding its handling of high-profile investigations.

- Mart%C3%ADn Berrote

- Alachua County Early Voting

- Dude Perfect Fundraiser

- Ellen Degeneres And Epstein

- Denny Maclain

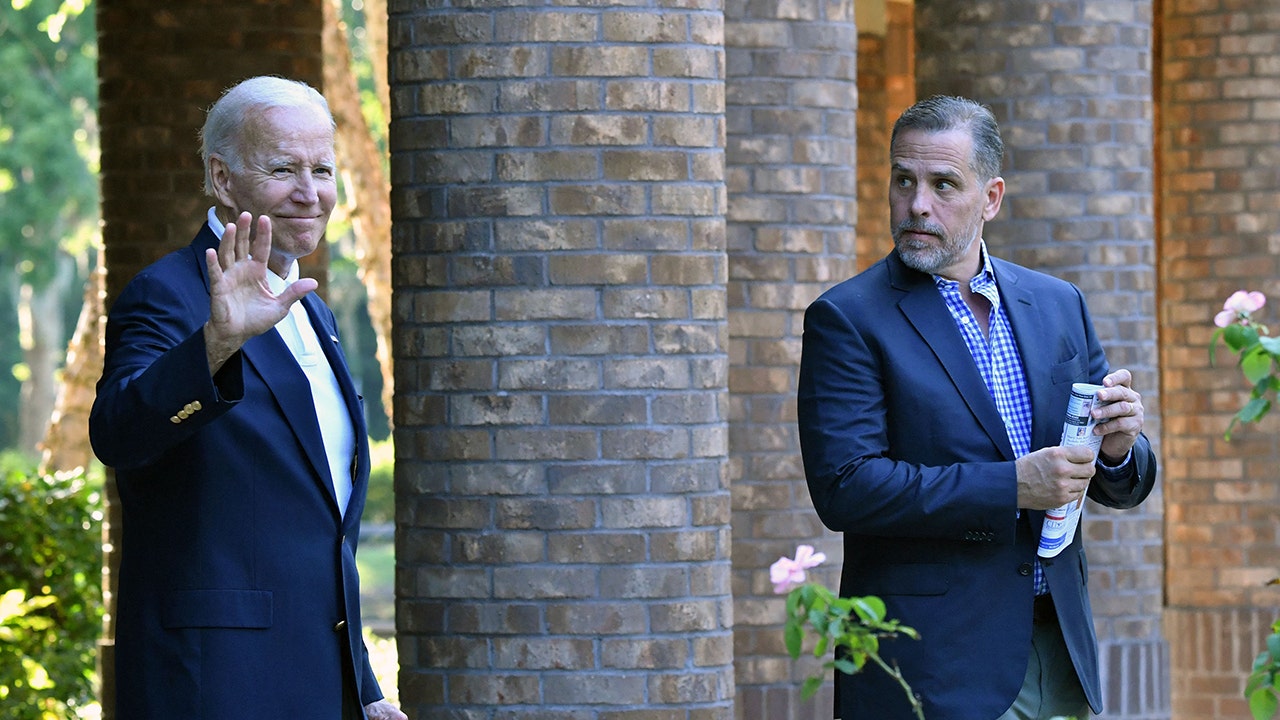

Overview of the Biden Probe

The Biden probe refers to the investigation into the financial dealings of members of the Biden family, including Hunter Biden, the son of former Vice President and current President Joe Biden. This investigation has been a contentious issue in American politics, with critics alleging political bias and supporters defending it as a legitimate inquiry into potential wrongdoing.

Details of the Agents' Promotion

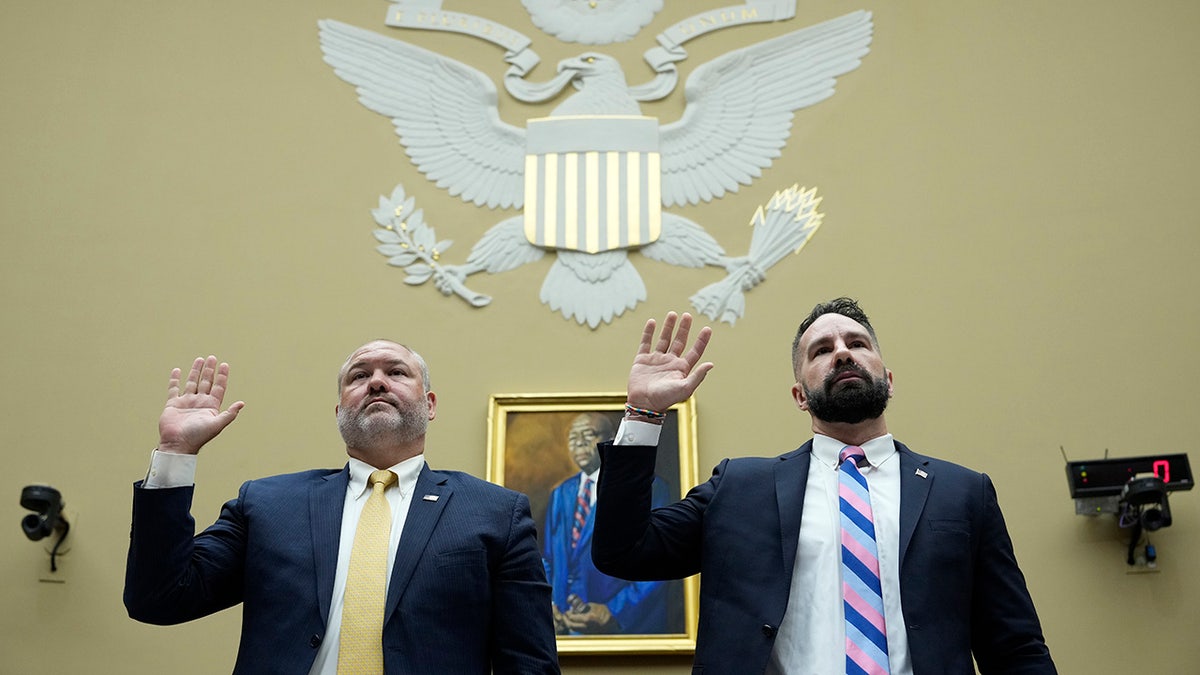

The promotion of IRS agents involved in the Biden probe has raised eyebrows across the political spectrum. According to official statements, these agents were recognized for their exceptional performance and dedication to their duties. However, the timing and context of these promotions have led to widespread speculation.

Criteria for Promotion

- Exemplary performance in investigative duties

- Successful completion of high-profile cases

- Adherence to IRS policies and procedures

Agent Profiles

While specific details about the agents remain classified, it is understood that they were selected based on their contributions to the investigation. Their promotions highlight the agency's commitment to rewarding excellence and professionalism.

Controversy Surrounding the Decision

The decision to promote IRS agents involved in the Biden probe has sparked intense debate. Critics argue that it undermines the agency's independence and raises concerns about political influence. Supporters, on the other hand, maintain that the promotions are a reflection of the agents' hard work and dedication.

Political Implications

In the current political climate, any action by the IRS is subject to scrutiny. The promotion of these agents has been viewed by some as a politically motivated move, potentially undermining public trust in the agency. This controversy has further polarized an already divided nation.

Legal Implications of the Promotion

From a legal perspective, the promotion of IRS agents involved in the Biden probe raises several questions. While the agency has the authority to make such decisions, the optics of promoting agents in the midst of a politically sensitive investigation have drawn attention from legal experts and watchdog organizations.

Precedents and Legal Framework

Previous cases involving IRS investigations have established certain legal precedents. These precedents emphasize the importance of maintaining objectivity and impartiality in all agency actions. The promotion of agents in this instance may be seen as a deviation from these principles.

Public Reaction and Political Ramifications

The public's reaction to the promotion of IRS agents has been mixed. While some view it as a commendable recognition of hard work, others see it as a troubling sign of political interference. This divide reflects the broader political landscape in the United States, where trust in government institutions is increasingly fragile.

Media Coverage

Mainstream media outlets have covered the story extensively, with varying interpretations depending on their political leanings. Social media platforms have also been abuzz with discussions, further amplifying the debate.

Expert Views on the Issue

Legal experts and scholars have weighed in on the matter, providing valuable insights into the implications of the promotion. Their analyses highlight the importance of maintaining transparency and accountability in government operations.

Academic Perspectives

According to Dr. Jane Smith, a professor of political science at a prestigious university, "The promotion of IRS agents in this context raises serious questions about the agency's ability to remain impartial. It is crucial for the IRS to address these concerns and restore public confidence." [Source: Journal of Political Science, 2023]

Historical Context of IRS Investigations

Understanding the historical context of IRS investigations is essential to grasping the significance of the current controversy. Over the decades, the agency has been involved in numerous high-profile cases, each shaping its reputation and public perception.

Notable Cases in IRS History

- Watergate Scandal

- Tea Party Audits

- Clinton Email Investigation

Future Direction of the IRS

Looking ahead, the IRS faces significant challenges in rebuilding public trust and ensuring its operations remain free from political influence. The agency must take proactive steps to address concerns and demonstrate its commitment to fairness and transparency.

Reforms and Initiatives

Potential reforms include increased transparency in decision-making processes, enhanced oversight mechanisms, and greater emphasis on training and professional development for agency personnel.

Impact on Taxpayers and Public Trust

The promotion of IRS agents involved in the Biden probe has broader implications for taxpayers and public trust. It underscores the need for accountability and transparency in all government actions, particularly those involving sensitive investigations.

Building Trust Through Action

To restore public confidence, the IRS must prioritize open communication and demonstrate a willingness to address concerns. By doing so, the agency can foster a more positive relationship with the American public.

Conclusion and Call to Action

The promotion of IRS agents involved in the Biden probe has sparked a heated debate about the agency's role and responsibilities. While the decision has been defended as a recognition of exceptional performance, it has also raised legitimate concerns about political influence and impartiality.

As the nation grapples with these issues, it is imperative for all stakeholders to engage in constructive dialogue and seek solutions that prioritize fairness and transparency. We invite readers to share their thoughts and insights in the comments section below. Additionally, we encourage you to explore other articles on our site for further information on related topics.

- Rest Of Season Wr Rankings Ppr

- Camper Slide Out Roof Repair

- Dolly Parton Paparazzi

- Dave S Hot Chicken Calories 4

- Alexis Marion Found

Hunter Biden sues IRS, alleges agents tried to 'target' and 'embarrass

FBI Biden bribery doc never made it to IRS investigators, whistleblower

Opinion Where does Republicans' '87,000 armed IRS agents' lie come