Inflation 2025: Understanding The Economic Challenges Ahead

Inflation 2025 is a topic that has captured the attention of economists, policymakers, and everyday consumers alike. As the global economy continues to evolve, understanding the potential trajectory of inflation is crucial for financial planning and stability. Whether you're a business owner, an investor, or simply someone looking to safeguard your savings, staying informed about inflation trends is essential.

The world has witnessed significant economic shifts over the past few decades, from technological advancements to global pandemics. These changes have directly influenced inflation rates, and as we approach 2025, experts are closely monitoring the factors that could drive inflation in the coming years. In this article, we will delve into the causes, effects, and strategies to mitigate the impact of inflation 2025.

This comprehensive guide aims to equip readers with the knowledge needed to navigate the complexities of inflation. By exploring historical trends, current economic conditions, and expert predictions, we will provide actionable insights to help you prepare for the future.

- Actors Born 1967

- Ellen Degeneres And Epstein

- Chris Distefano Daughter

- Best Restaurants Near Nederlander Theater Nyc

- Misha Collins Young

Table of Contents

- What is Inflation?

- Causes of Inflation

- Effects of Inflation

- Historical Trends of Inflation

- Global Factors Influencing Inflation 2025

- Key Economic Indicators to Watch

- Strategies to Mitigate Inflation

- Predictions for Inflation 2025

- Impact on Consumers and Businesses

- Conclusion

What is Inflation?

Inflation refers to the sustained increase in the general price level of goods and services over time. It is measured as an annual percentage increase and is a key indicator of a country's economic health. Inflation 2025 is expected to be influenced by a combination of domestic and international factors, making it a critical topic for discussion.

Understanding inflation requires examining its underlying causes and effects. For instance, inflation can erode purchasing power, meaning that consumers can buy fewer goods and services with the same amount of money. This phenomenon affects everyone, from households to large corporations.

Inflation is typically measured using indices such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). These indices track the price changes of a basket of goods and services, providing a snapshot of inflation trends.

Causes of Inflation

1. Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds supply. This situation often arises during periods of economic growth, where consumers have more disposable income to spend. Inflation 2025 could be driven by increased consumer demand, especially if economic recovery continues post-pandemic.

2. Cost-Push Inflation

Cost-push inflation happens when the cost of production increases, such as wages, raw materials, or energy prices. For example, rising oil prices can lead to higher transportation costs, which are then passed on to consumers. Inflation 2025 may see significant contributions from cost-push factors, particularly if global supply chains remain disrupted.

3. Monetary Policies

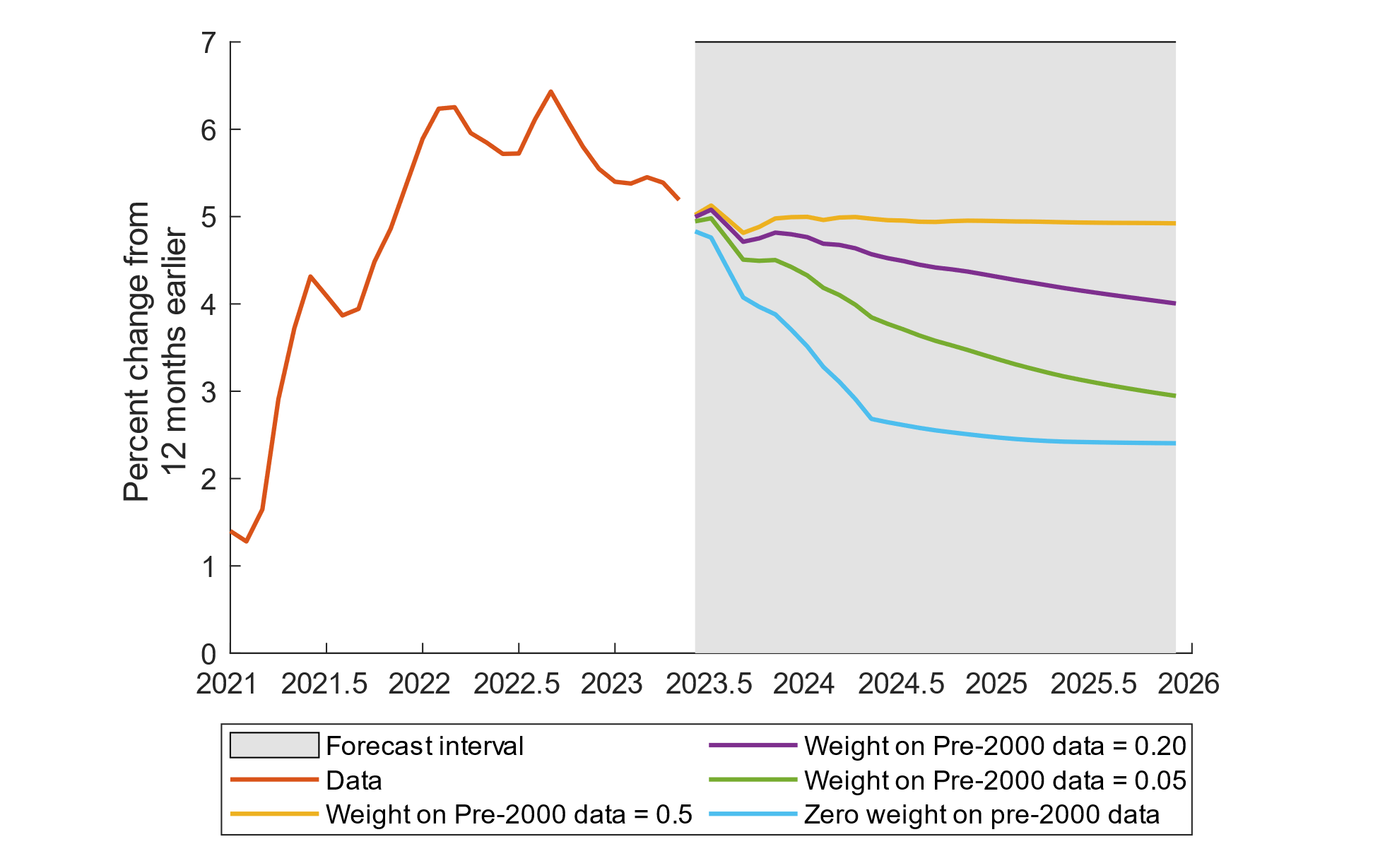

Monetary policies, such as quantitative easing and interest rate adjustments, can also influence inflation. Central banks often use these tools to control inflation by managing the money supply. Inflation 2025 will likely depend on how central banks respond to economic conditions and adjust their policies accordingly.

Effects of Inflation

The effects of inflation are far-reaching and can impact various aspects of the economy. Below are some key consequences:

- Erosion of Purchasing Power: As prices rise, the value of money decreases, reducing consumers' ability to purchase goods and services.

- Impact on Savings: Inflation can diminish the real value of savings, especially if interest rates do not keep pace with inflation rates.

- Wage Adjustments: Workers may demand higher wages to compensate for the rising cost of living, which can further fuel inflation.

- Investment Opportunities: Inflation can create both risks and opportunities for investors, depending on the asset classes they choose.

Understanding these effects is crucial for individuals and businesses as they prepare for inflation 2025.

Historical Trends of Inflation

To better predict inflation 2025, it is essential to examine historical trends. Over the past century, inflation has experienced significant fluctuations, influenced by events such as wars, economic crises, and technological advancements.

For example, the 1970s saw high inflation rates due to oil price shocks and loose monetary policies. Conversely, the early 2000s experienced relatively low inflation, partly due to globalization and increased competition. By studying these patterns, economists can identify potential triggers for inflation 2025.

Data from sources like the International Monetary Fund (IMF) and the World Bank provide valuable insights into historical inflation trends. These institutions offer comprehensive reports and datasets that can help policymakers and researchers make informed decisions.

Global Factors Influencing Inflation 2025

1. Climate Change

Climate change is increasingly becoming a factor in inflation. Extreme weather events can disrupt agricultural production, leading to higher food prices. Inflation 2025 may see increased pressure on food and energy sectors due to climate-related challenges.

2. Geopolitical Tensions

Geopolitical tensions, such as trade wars and conflicts, can also impact inflation. Tariffs and sanctions can lead to higher prices for imported goods, contributing to inflationary pressures. As global relations continue to evolve, their impact on inflation 2025 will be closely monitored.

3. Technological Advancements

On the other hand, technological advancements can help mitigate inflation by increasing efficiency and reducing costs. Automation and artificial intelligence are transforming industries, potentially offsetting some of the inflationary pressures expected in 2025.

Key Economic Indicators to Watch

To gauge the potential trajectory of inflation 2025, it is essential to monitor key economic indicators. These include:

- Consumer Price Index (CPI): Tracks changes in the price of goods and services purchased by households.

- Gross Domestic Product (GDP): Measures the economic output of a country and provides insights into economic growth.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed and actively seeking employment.

- Interest Rates: Reflects the cost of borrowing and can influence consumer spending and investment.

By keeping an eye on these indicators, policymakers and consumers can better anticipate and respond to inflationary trends.

Strategies to Mitigate Inflation

1. Diversify Investments

Investors can protect their portfolios from inflation by diversifying across asset classes. Commodities, real estate, and stocks in industries resistant to inflation can provide a hedge against rising prices.

2. Increase Savings

Building a robust savings cushion is essential for individuals to weather the effects of inflation. Consider high-yield savings accounts or certificates of deposit that offer competitive interest rates.

3. Improve Financial Literacy

Enhancing financial literacy can empower consumers to make informed decisions about spending, saving, and investing. Understanding inflation 2025 and its implications is a crucial step in financial planning.

Predictions for Inflation 2025

Experts predict that inflation 2025 will be shaped by several factors, including post-pandemic recovery, technological advancements, and global trade dynamics. While some forecasts suggest moderate inflation, others warn of potential spikes if certain risks materialize.

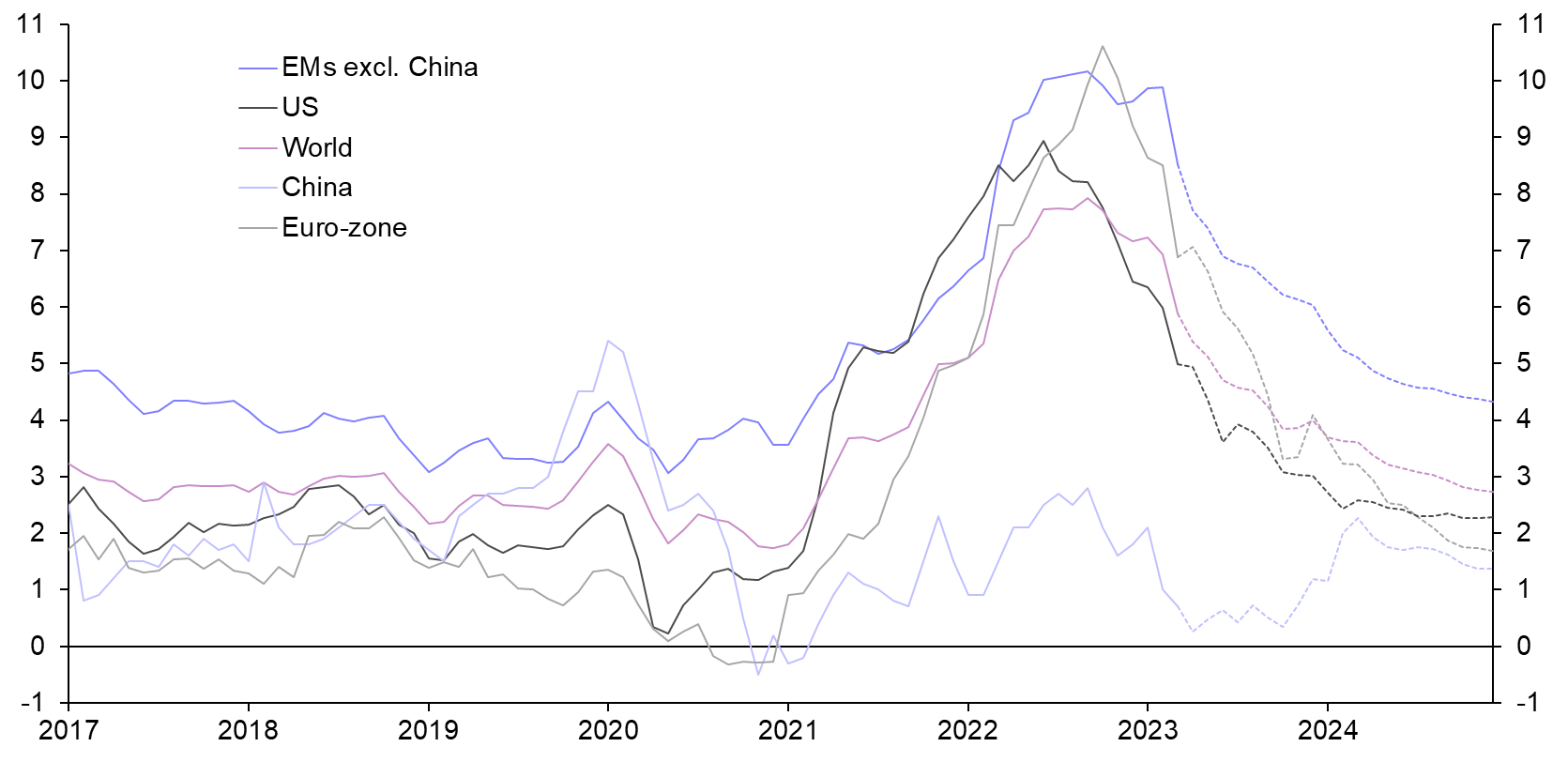

According to a report by the IMF, inflation in developed economies is expected to remain below historical averages, while emerging markets may experience higher inflation rates. However, these predictions are subject to change based on evolving economic conditions.

Staying informed about inflation 2025 requires continuous monitoring of economic data and expert analyses. Subscribing to reputable financial news sources and consulting with financial advisors can help individuals stay ahead of inflationary trends.

Impact on Consumers and Businesses

Inflation 2025 will have varying impacts on consumers and businesses. For consumers, rising prices may necessitate changes in spending habits and budgeting strategies. Businesses, on the other hand, may need to adjust pricing models, optimize supply chains, and invest in innovation to remain competitive.

Small businesses, in particular, may face challenges in adapting to inflationary pressures. Access to affordable financing and support from government programs can play a crucial role in helping these businesses thrive in an inflationary environment.

Ultimately, the key to navigating inflation 2025 lies in proactive planning and adaptability. Both consumers and businesses must remain vigilant and prepared to respond to changing economic conditions.

Conclusion

Inflation 2025 is a topic of significant importance, with far-reaching implications for the global economy. By understanding the causes, effects, and strategies to mitigate inflation, individuals and businesses can better prepare for the future. Staying informed about economic indicators and expert predictions is essential for making sound financial decisions.

We encourage readers to share their thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for more insights into economic trends and financial planning. Together, we can build a more resilient and informed community in the face of inflation 2025.

- Trader Joe S Premade Sandwiches

- When Do Elf On Shelf Come Back

- Dan Burkes Net Worth

- Eva Mendez Kids

- Andrew Wk Discography

Inflation From 2025 To 2025 Christopher Robertson

Inflation 2025 Deutschland Heath Elizabeth

1978 To 2025 Inflation Minna Sydelle