Best Bitcoin Investment Strategies And Opportunities In 2023

Bitcoin has become one of the most popular digital assets worldwide, offering immense potential for investors looking to diversify their portfolios. As the first decentralized cryptocurrency, it continues to dominate the crypto market, attracting both seasoned investors and newcomers. If you're interested in exploring the best Bitcoin investment opportunities, this article provides a comprehensive guide to help you make informed decisions.

The rise of Bitcoin as a global financial phenomenon has sparked a wave of interest among individuals seeking to capitalize on its growth. Understanding the nuances of Bitcoin investments is crucial for maximizing returns while minimizing risks. This article delves into various strategies, tools, and insights to help you navigate the complex world of cryptocurrency investing.

As the crypto market continues to evolve, staying updated with the latest trends and strategies is essential for anyone looking to invest in Bitcoin. This guide will explore the best practices, tools, and insights to help you harness the full potential of Bitcoin investments while ensuring your financial security.

- Raised Ranch Front Porch

- Butterball Tirkey Scandal

- Wilma Tisch

- Brunch Near Lewisville Tx

- Young Victoria Justice

Table of Contents:

- Biography of Bitcoin

- Best Bitcoin Investment Strategies

- Market Analysis for Bitcoin

- Security Measures for Bitcoin Investors

- Long-Term Potential of Bitcoin

- Risks and Challenges in Bitcoin Investing

- Tools and Platforms for Bitcoin Investors

- Legal and Regulatory Considerations

- Community Insights on Bitcoin

- Future Trends in Bitcoin Investing

Biography of Bitcoin

Bitcoin, created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto, revolutionized the concept of digital currency. It operates on a decentralized network called blockchain, which ensures transparency and security in transactions. Below is a summary of Bitcoin's key details:

| Attribute | Detail |

|---|---|

| Creator | Satoshi Nakamoto |

| Launch Date | January 3, 2009 |

| Supply Limit | 21 million |

| Market Capitalization | $900 billion (as of 2023) |

| Technology | Blockchain |

Best Bitcoin Investment Strategies

1. Dollar-Cost Averaging

Dollar-cost averaging is one of the most popular strategies for investing in Bitcoin. This method involves regularly purchasing a fixed dollar amount of Bitcoin over time, regardless of its price fluctuations. By spreading out investments, investors can reduce the impact of market volatility on their overall portfolio.

- Wolfeboro Rail Trail

- Power 105 Fm Breakfast Club

- Dr Baak St Louis

- Joan Embery San Diego Zoo

- Helene Cape Coral Fl

2. Long-Term HODLing

HODLing, a term derived from "hold," refers to holding onto Bitcoin for an extended period. This strategy is ideal for those who believe in the long-term potential of Bitcoin and are willing to ride out short-term market fluctuations.

3. Trading Bitcoin

For more active investors, trading Bitcoin on exchanges can be a lucrative option. However, it requires a deep understanding of market trends, technical analysis, and risk management. Traders often use tools like candlestick charts and indicators to make informed decisions.

Market Analysis for Bitcoin

Understanding the Bitcoin market requires analyzing various factors, including price trends, adoption rates, and macroeconomic influences. As of 2023, Bitcoin's market capitalization has grown significantly, driven by increased institutional interest and mainstream adoption.

Key statistics:

- Bitcoin's market share accounts for over 40% of the total cryptocurrency market.

- Institutional investment in Bitcoin has surged, with major companies like Tesla and MicroStrategy holding significant amounts of the digital asset.

- Global adoption of Bitcoin continues to rise, with countries like El Salvador adopting it as legal tender.

Security Measures for Bitcoin Investors

Security is paramount when investing in Bitcoin. Investors must take necessary precautions to protect their digital assets from theft and fraud. Below are some best practices:

1. Use Hardware Wallets

Hardware wallets, such as Ledger and Trezor, provide an extra layer of security by storing private keys offline. This makes it nearly impossible for hackers to access your Bitcoin.

2. Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an additional layer of security to your online accounts, reducing the risk of unauthorized access.

3. Stay Informed About Scams

Be vigilant about potential scams, such as phishing attacks and fake investment schemes. Always verify the legitimacy of platforms and individuals before sharing personal or financial information.

Long-Term Potential of Bitcoin

Bitcoin's long-term potential is driven by its limited supply, increasing adoption, and use cases beyond just a store of value. As more businesses and governments recognize its value, Bitcoin is likely to continue gaining traction as a global financial asset.

Experts predict that Bitcoin could reach a market capitalization of $1 trillion or more in the coming years, driven by factors such as:

- Increasing institutional adoption

- Growing acceptance as a payment method

- Advancements in blockchain technology

Risks and Challenges in Bitcoin Investing

While Bitcoin offers immense potential, it also comes with risks and challenges that investors must be aware of. These include:

1. Market Volatility

Bitcoin's price is highly volatile, with fluctuations often driven by market sentiment, news events, and regulatory changes. Investors must be prepared for price swings and have a risk management strategy in place.

2. Regulatory Uncertainty

Regulatory developments can significantly impact the Bitcoin market. Some countries have imposed restrictions on cryptocurrency trading, while others have embraced it. Staying informed about regulatory changes is crucial for Bitcoin investors.

3. Security Risks

As mentioned earlier, security is a major concern for Bitcoin investors. Cyberattacks, phishing scams, and other forms of fraud can result in significant financial losses if proper precautions are not taken.

Tools and Platforms for Bitcoin Investors

Various tools and platforms are available to help Bitcoin investors make informed decisions. These include:

1. Cryptocurrency Exchanges

Exchanges like Coinbase, Binance, and Kraken allow users to buy, sell, and trade Bitcoin. They also provide additional features such as staking and lending opportunities.

2. Wallets

Bitcoin wallets, both hardware and software-based, offer secure storage solutions for digital assets. Popular options include Ledger, Trezor, and Exodus.

3. Analytical Tools

Tools like TradingView and CoinMarketCap provide valuable insights into market trends, price movements, and other key metrics. These platforms are essential for both novice and experienced investors.

Legal and Regulatory Considerations

Bitcoin's legal status varies across countries, with some embracing it while others imposing strict regulations. Investors must familiarize themselves with the legal framework in their jurisdiction to ensure compliance.

Key considerations:

- Understand tax implications of Bitcoin transactions

- Be aware of anti-money laundering (AML) and know-your-customer (KYC) requirements

- Stay updated on regulatory developments affecting Bitcoin

Community Insights on Bitcoin

The Bitcoin community is a vibrant and diverse group of individuals, ranging from developers and miners to investors and enthusiasts. Engaging with the community can provide valuable insights and networking opportunities.

Popular forums and platforms for connecting with the Bitcoin community include:

- Reddit's r/Bitcoin

- Bitcoin Talk Forum

- Social media groups on Twitter and Telegram

Future Trends in Bitcoin Investing

The future of Bitcoin investing is shaped by emerging trends and innovations in the cryptocurrency space. These include:

1. Decentralized Finance (DeFi)

DeFi platforms are revolutionizing traditional financial systems by offering decentralized alternatives to banking, lending, and trading. Bitcoin's integration with DeFi could unlock new opportunities for investors.

2. Central Bank Digital Currencies (CBDCs)

As more countries explore the development of CBDCs, Bitcoin's role in the global financial system may evolve. Investors should monitor these developments closely to assess their impact on Bitcoin's value and adoption.

3. Environmental Concerns

The environmental impact of Bitcoin mining has become a growing concern. Innovations in sustainable mining practices and the adoption of renewable energy sources could address these challenges, enhancing Bitcoin's long-term viability.

Conclusion

Investing in Bitcoin offers a unique opportunity to participate in the rapidly evolving world of digital currencies. By understanding the best investment strategies, staying informed about market trends, and taking necessary security measures, investors can maximize their returns while minimizing risks.

We encourage you to share your thoughts and experiences with Bitcoin investing in the comments section below. Additionally, consider exploring other articles on our site for more insights into the world of cryptocurrency and finance. Together, let's build a brighter financial future!

- Jasmine Richardson Murder

- Actors Born 1967

- Simon Cowell Conservationist

- Qt Hutto

- Bus Schedule Fremont

Grayscale’s Bitcoin SellOff Pace Decreases Potential Price Impact

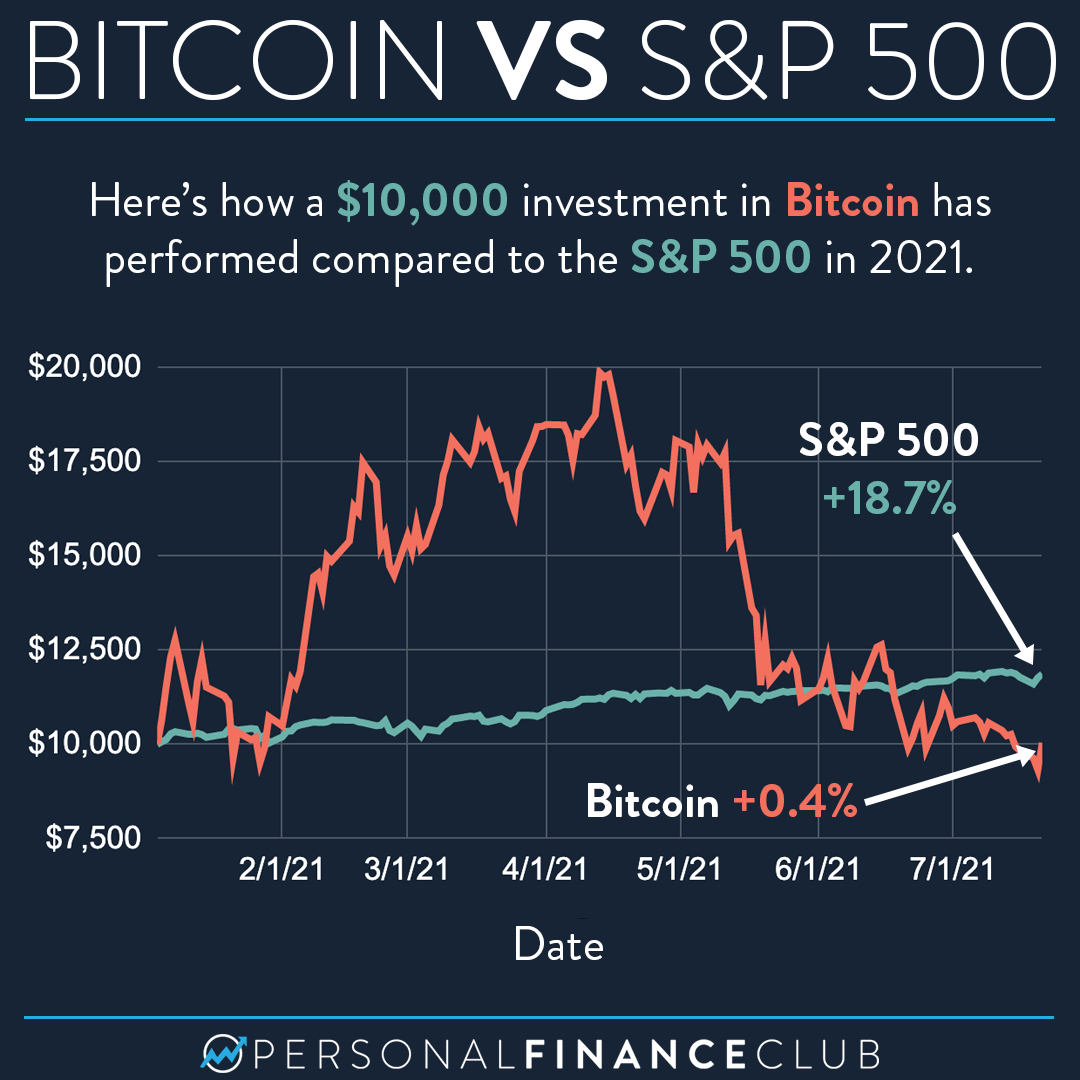

Here’s how Bitcoin performed compared to the S&P 500 in 2021 Personal

Bitcoin (BTC) Wallets Cross 48 Million for the First Time