Where's My Refund: A Comprehensive Guide To Understanding And Resolving Your Refund Issues

Dealing with refund issues can be frustrating, especially when you’re asking yourself, "Where's my refund?" Whether it's related to a product return, canceled services, or travel bookings, knowing how to navigate the refund process is essential. Understanding your rights and the steps to follow can make all the difference in resolving these matters effectively.

Refunds are an integral part of consumer protection, ensuring that buyers receive fair treatment when things don’t go as planned. In this article, we’ll explore the ins and outs of the refund process, including common reasons for delays, how to track your refund, and what to do if you encounter issues. Whether you're dealing with online purchases, subscriptions, or other financial transactions, this guide will equip you with the knowledge you need.

By the end of this article, you’ll have a clear understanding of where your refund might be, the steps you can take to expedite the process, and how to protect yourself in the future. Let’s dive in and answer the question that’s on your mind: "Where's my refund?"

- Property Taxes In Malibu California

- Mcdonalds Grinch Happy Meal

- Carey Bringle

- Steep Vs Shallow Golf Swing

- Secretive Stash Sea Of Thieves

Table of Contents

- Understanding Refunds and Their Importance

- Common Reasons Why You Might Ask, "Where's My Refund?"

- How to Track Your Refund

- The Refund Process Explained

- Your Consumer Rights in Refund Matters

- Steps to Contact Customer Support

- Resolving Refund Disputes

- Tips to Prevent Future Refund Issues

- Refund Statistics and Insights

- Conclusion: Taking Control of Your Refund Journey

Understanding Refunds and Their Importance

Refunds play a crucial role in maintaining trust between businesses and consumers. A refund is essentially the return of money to a customer after a purchase has been made under specific circumstances, such as dissatisfaction with the product, cancellation of services, or errors in the transaction process. Understanding the concept of refunds and their significance can help you navigate the system more effectively.

For instance, if you’ve recently purchased an item online and realized it doesn’t meet your expectations, you might be wondering, "Where's my refund?" The refund process can vary depending on the merchant’s policies, the type of product, and the method of payment used. In some cases, refunds are processed quickly, while in others, they may take several weeks to reflect in your account.

It’s important to familiarize yourself with the refund policies of the businesses you transact with. This knowledge can help you manage expectations and avoid unnecessary frustration. Additionally, understanding your rights as a consumer can empower you to take action when needed.

- Ros Wr Rankings Half Ppr

- Did Jenna Fischer And John Krasinski Date

- Christ Sabat

- Short Perm Hair Men

- Does Mcdonald S Have The Grinch Happy Meal

Common Reasons Why You Might Ask, "Where's My Refund?"

There are several reasons why you might find yourself wondering, "Where's my refund?" Below are some of the most common scenarios:

- Product Returns: You returned an item, but the refund hasn’t been processed yet.

- Canceled Subscriptions: You canceled a subscription service, but the refund hasn’t been issued.

- Travel Bookings: A flight, hotel, or travel package was canceled, but the refund is delayed.

- Payment Errors: A duplicate charge occurred, and you’re waiting for the refund to be credited back.

Each of these situations can lead to delays or complications in the refund process. Understanding the specific circumstances surrounding your refund request is the first step toward resolving the issue.

Delayed Refunds: What to Expect

Delays in refund processing are more common than you might think. Factors such as the merchant’s refund policy, the method of payment, and the banking system can all contribute to delays. For example, credit card refunds typically take 5-7 business days to reflect in your account, while bank transfers may take longer.

If you’re experiencing a delay, it’s important to remain patient and follow up with the appropriate parties. Keep records of all correspondence and documentation related to your refund request, as this can be helpful in resolving disputes.

How to Track Your Refund

Tracking your refund can provide peace of mind and help you stay informed about the status of your request. Here are some steps you can take to monitor the progress of your refund:

- Check the Merchant’s Website: Many businesses offer a tracking tool on their website where you can input your order number to check the status of your refund.

- Review Your Bank Statements: Regularly check your bank or credit card statements for any updates on your refund. Sometimes, refunds appear as pending transactions before being fully credited.

- Contact Customer Support: If you’re unable to track your refund online, reach out to the merchant’s customer support team for assistance.

By taking these proactive steps, you can stay informed and address any issues that arise during the refund process.

The Refund Process Explained

The refund process typically involves several steps, from initiating the request to receiving the funds in your account. Understanding each step can help you manage expectations and avoid confusion. Below is a breakdown of the refund process:

- Initiation: The refund process begins when you request a refund from the merchant or service provider.

- Verification: The merchant verifies your request, ensuring that it meets their refund policy criteria.

- Processing: Once verified, the merchant initiates the refund process, which involves sending the funds back to your payment method.

- Settlement: The final step is the settlement, where the refund is credited to your account by your bank or credit card issuer.

Each step in the process can vary in duration, depending on the merchant’s policies and the efficiency of the payment system involved.

Factors Affecting Refund Speed

Several factors can impact how quickly you receive your refund. These include:

- Merchant Policies: Some merchants have stricter refund policies, which can delay the process.

- Payment Method: Credit card refunds are generally faster than bank transfers or checks.

- Bank Processing Times: Banks may take additional time to process refunds, especially during busy periods.

Being aware of these factors can help you better understand why your refund might be taking longer than expected.

Your Consumer Rights in Refund Matters

As a consumer, you have certain rights that protect you in refund situations. These rights are often governed by consumer protection laws, which vary by country. In many cases, businesses are required to offer refunds under specific circumstances, such as:

- Product Defects: If a product is faulty or doesn’t meet the advertised description.

- Non-Delivery: If a product or service was not delivered as promised.

- Cancellation Rights: Many businesses offer cancellation rights within a specific time frame after purchase.

Knowing your rights can empower you to advocate for yourself when dealing with refund issues. If a merchant refuses to issue a refund despite your legal entitlement, you may need to escalate the matter to a consumer protection agency.

Steps to Contact Customer Support

If you’re struggling to resolve your refund issue on your own, contacting customer support is the next logical step. Here’s how you can approach the situation:

- Gather Documentation: Collect all relevant documents, including order confirmations, return receipts, and correspondence with the merchant.

- Choose the Right Channel: Determine the best way to contact customer support, whether it’s via phone, email, or live chat.

- Be Polite and Persistent: Clearly explain your situation and provide all necessary details. If you don’t receive a satisfactory response, escalate the issue to a higher authority within the company.

Effective communication with customer support can often lead to a resolution of your refund issue.

What to Do If Customer Support Fails

In cases where customer support fails to address your concerns, you may need to explore alternative options. These include filing a complaint with a consumer protection agency or initiating a chargeback through your credit card issuer. Chargebacks allow you to dispute a transaction and request a refund directly from your bank.

Resolving Refund Disputes

Refund disputes can arise when there is a disagreement between the consumer and the merchant regarding the refund request. In such cases, it’s important to remain calm and follow a systematic approach to resolving the issue. Below are some strategies for handling refund disputes:

- Document Everything: Keep detailed records of all communications and transactions related to the dispute.

- Escalate the Issue: If initial attempts to resolve the dispute fail, escalate the matter to a higher authority within the company or seek external assistance.

- Consider Legal Action: As a last resort, you may need to pursue legal action to recover your funds.

Resolving refund disputes can be challenging, but persistence and documentation can often lead to a successful outcome.

Tips to Prevent Future Refund Issues

Prevention is always better than cure. To avoid refund issues in the future, consider the following tips:

- Read Refund Policies Carefully: Before making a purchase, review the merchant’s refund policy to ensure it aligns with your expectations.

- Keep Receipts and Documentation: Always save copies of receipts, order confirmations, and any other relevant documents.

- Monitor Your Accounts Regularly: Regularly check your bank and credit card statements for any discrepancies or unauthorized charges.

By adopting these preventive measures, you can minimize the likelihood of encountering refund issues in the future.

Refund Statistics and Insights

Understanding refund statistics can provide valuable insights into the refund landscape. According to a report by the Federal Trade Commission (FTC), refund disputes accounted for a significant percentage of consumer complaints in 2022. The report highlighted common issues such as delayed refunds, unauthorized charges, and misleading refund policies.

Another study by the Consumer Financial Protection Bureau (CFPB) revealed that credit card users were more likely to receive timely refunds compared to those using other payment methods. These statistics underscore the importance of choosing the right payment method and understanding your rights as a consumer.

Conclusion: Taking Control of Your Refund Journey

In conclusion, answering the question, "Where's my refund?" involves understanding the refund process, your rights as a consumer, and the steps you can take to resolve issues effectively. By following the guidelines outlined in this article, you can navigate the refund process with confidence and minimize frustration.

We encourage you to take action by reviewing your refund policies, monitoring your accounts, and reaching out to customer support if necessary. Don’t hesitate to share this article with others who may find it helpful or leave a comment below with your thoughts and experiences. Together, we can create a more informed and empowered consumer community.

- Dolly Parton Paparazzi

- Hutson John Deere Evansville Indiana

- Trader Joe S Premade Sandwiches

- Indiana Dunes Cabin

- Lab Rats Billy Unger

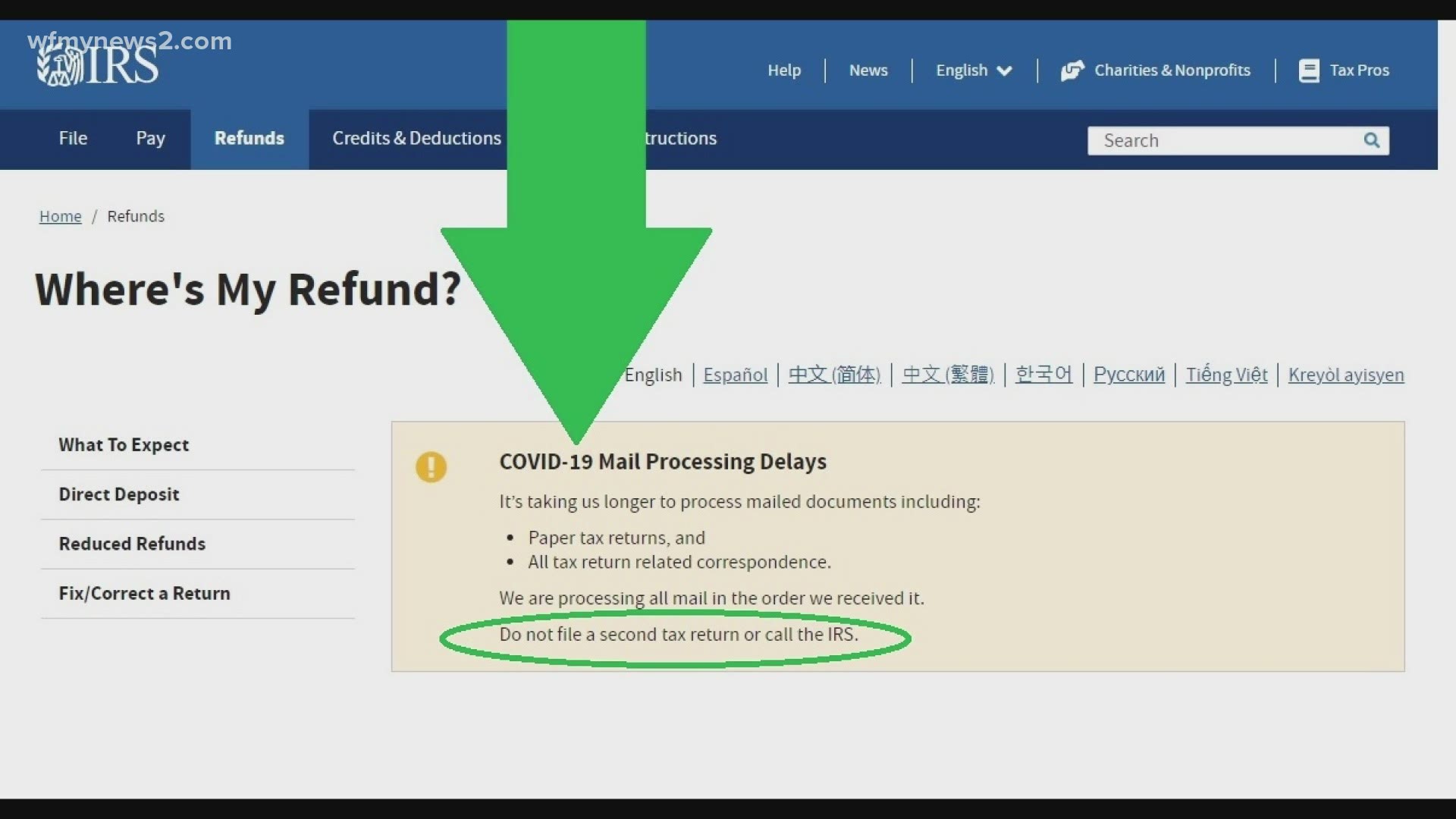

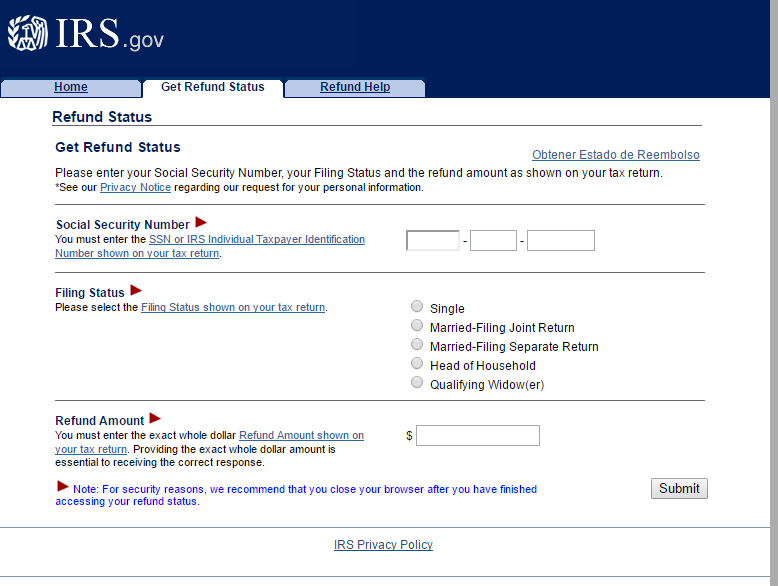

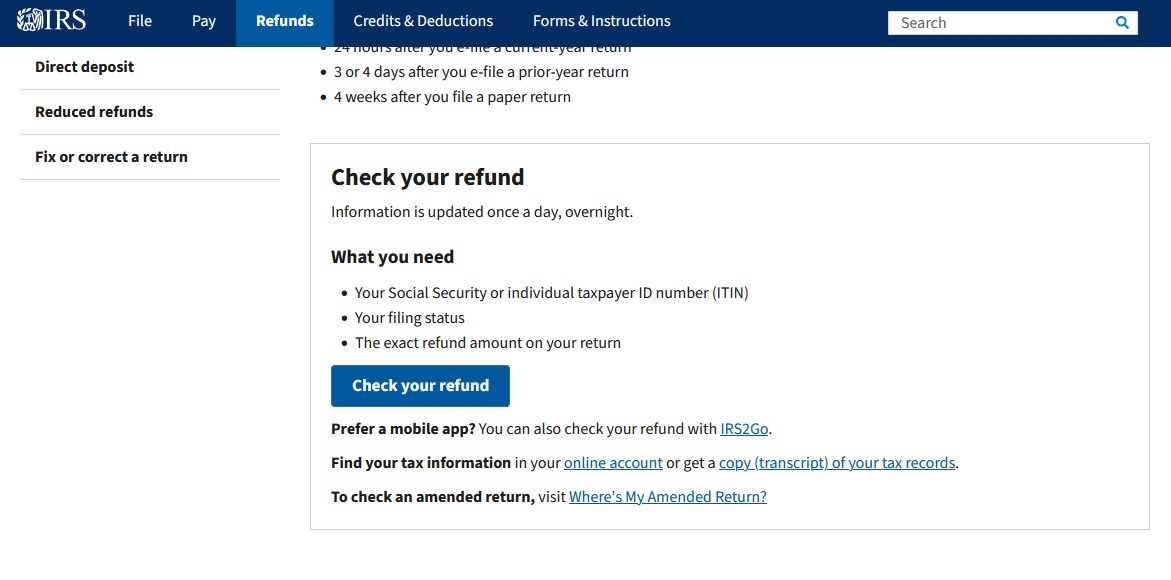

Irs Where's My Refund

IRS Where's My Refund IRS Refunds 2021 Refund Schedule 2022

wheres my refund2 ⋆ Where's My Refund? Tax News & Information