Maximizing Your IRS Tax Refunds 2025: A Comprehensive Guide

As the year 2025 approaches, many taxpayers are eagerly anticipating their IRS tax refunds. The Internal Revenue Service (IRS) plays a crucial role in ensuring that individuals receive the financial relief they deserve. Whether you're filing for the first time or seeking ways to optimize your refund, understanding the nuances of IRS tax refunds is essential for maximizing your returns. This article will delve into everything you need to know about IRS tax refunds in 2025, providing actionable insights and expert advice.

Tax refunds are not just about getting money back; they represent an opportunity to regain funds that were overpaid throughout the year. With inflation on the rise and economic uncertainties looming, these refunds can serve as a financial cushion for individuals and families alike. Understanding how the IRS calculates refunds, what factors influence them, and how to avoid common pitfalls is key to ensuring you receive the largest possible refund.

In this comprehensive guide, we'll explore everything from eligibility criteria to filing strategies, along with tips to avoid errors that could delay your refund. By the end of this article, you'll be equipped with the knowledge needed to navigate the 2025 tax season successfully.

- The Haven Arroyo Grande

- Rucci Rims Price

- How Did Curly Die

- Redeem Hsr

- How To Say Nice To Meet You In Mandarin

Table of Contents

- Understanding IRS Tax Refunds

- Eligibility Criteria for IRS Tax Refunds 2025

- Filing Options for IRS Tax Refunds

- Common Deductions to Maximize Your Refund

- Tax Credits and Their Impact on Refunds

- How to Avoid Delays in Receiving Your Refund

- The IRS Refund Process Explained

- Impact of Tax Reforms on 2025 Refunds

- Planning Ahead for Future Refunds

- Conclusion and Call to Action

Understanding IRS Tax Refunds

IRS tax refunds are essentially the return of excess taxes paid to the government during the fiscal year. When taxpayers pay more in taxes than they owe, the IRS issues a refund to balance the difference. For 2025, the IRS has introduced several updates to streamline the refund process and enhance taxpayer benefits.

How Are Refunds Calculated?

The IRS calculates refunds by comparing the total tax liability of an individual with the amount of taxes already paid through withholdings or estimated payments. Factors such as deductions, credits, and exemptions significantly influence the final refund amount. According to a report by the IRS, the average refund for 2024 was approximately $2,800, and projections suggest a similar trend for 2025.

Key Benefits of IRS Tax Refunds

- Financial relief for taxpayers

- Opportunity to invest in savings or debt repayment

- Support for economic growth through consumer spending

Eligibility Criteria for IRS Tax Refunds 2025

Not everyone qualifies for an IRS tax refund. Eligibility depends on various factors, including income level, filing status, and the type of taxes paid. Below are the primary criteria for receiving a refund in 2025:

- Nancy Actor

- Cape Coral Florida Helene

- Alachua County Early Voting 2024

- Betrayal Ashley

- Ros Fantasy Football Rankings Ppr

Income Thresholds

Taxpayers earning below a certain income threshold may qualify for additional credits and deductions, increasing their chances of receiving a refund. The IRS provides detailed guidelines on income limits for different filing statuses, which can be found in their official publications.

Filing Status

Your filing status—whether single, married filing jointly, head of household, or qualifying widow(er)—affects your eligibility for certain deductions and credits. Understanding your specific status is crucial for optimizing your refund.

Filing Options for IRS Tax Refunds

In 2025, taxpayers have multiple options for filing their tax returns. The IRS encourages electronic filing due to its speed and accuracy. However, traditional paper filings are still accepted for those who prefer them.

Electronic Filing

Electronic filing, or e-filing, is the fastest way to receive your IRS tax refund. According to the IRS, e-filed returns are processed within 21 days, compared to six weeks for paper filings. Additionally, e-filing reduces the risk of errors, ensuring a smoother refund process.

Paper Filing

For those without access to digital tools or who prefer traditional methods, paper filing remains an option. While it takes longer, the IRS ensures all paper filings are processed accurately and promptly.

Common Deductions to Maximize Your Refund

Taking advantage of available deductions can significantly boost your IRS tax refund. Below are some of the most common deductions for 2025:

- Standard Deduction: Increased for 2025 to accommodate inflation

- Itemized Deductions: Includes mortgage interest, charitable contributions, and medical expenses

- Education Deductions: Such as the Lifetime Learning Credit and Tuition and Fees Deduction

Tax Credits and Their Impact on Refunds

Tax credits directly reduce the amount of tax owed, often resulting in larger refunds. Some of the key credits for 2025 include:

Child Tax Credit

This credit provides financial assistance to families with dependent children. For 2025, the credit amount has been adjusted to reflect current economic conditions.

Earned Income Tax Credit (EITC)

Designed to benefit low- to moderate-income workers, the EITC can result in substantial refunds for eligible taxpayers. The IRS estimates that millions of taxpayers claim this credit annually.

How to Avoid Delays in Receiving Your Refund

Delays in receiving IRS tax refunds are often caused by errors in filing or missing information. To ensure timely processing:

- Double-check all forms for accuracy

- Ensure your bank account information is correct for direct deposit

- File as early as possible to avoid end-of-season congestion

The IRS Refund Process Explained

The IRS follows a systematic process for issuing refunds. Once a return is submitted, it undergoes verification to ensure accuracy and compliance. If approved, the refund is issued via direct deposit or check, depending on the taxpayer's preference.

Tracking Your Refund

Taxpayers can track their refund status using the IRS's "Where's My Refund?" tool. This online service provides real-time updates on the processing status and expected delivery date.

Impact of Tax Reforms on 2025 Refunds

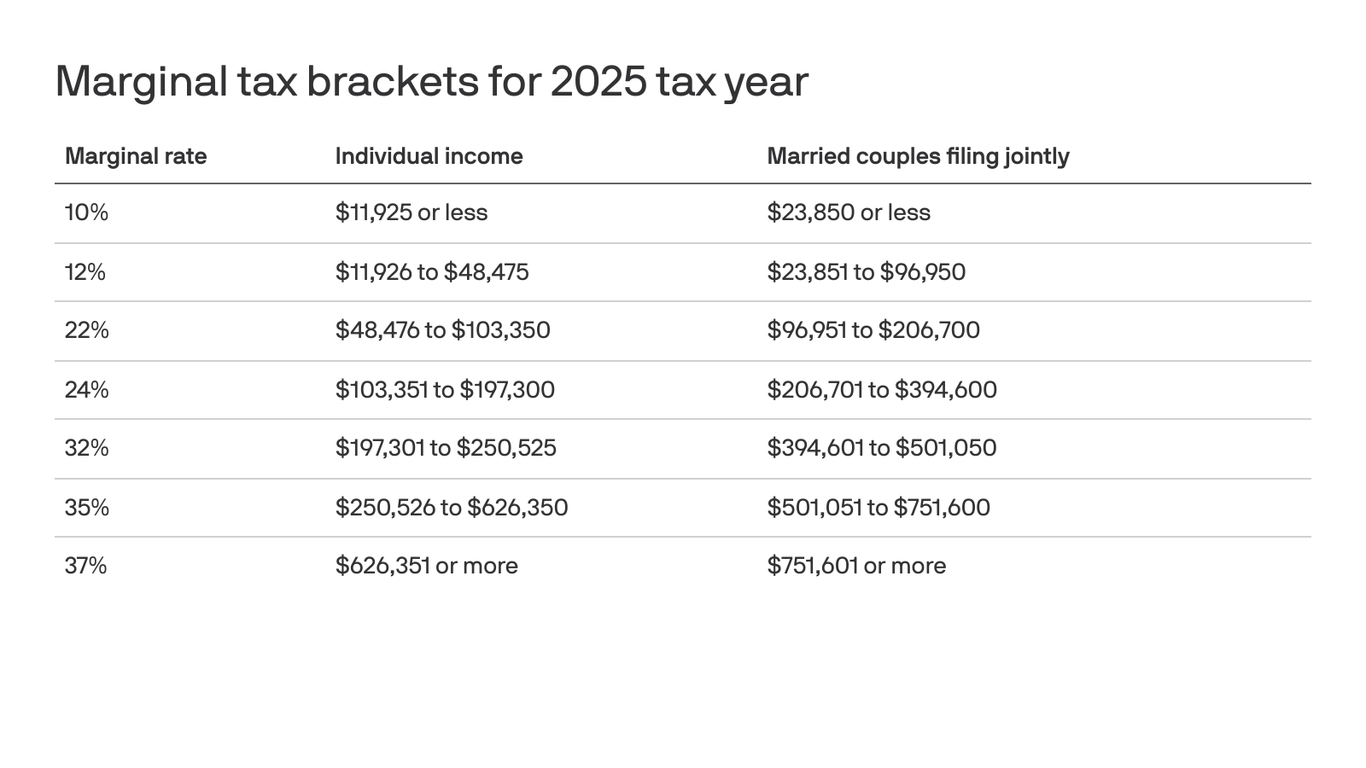

Recent tax reforms have introduced changes that could affect 2025 refunds. These include adjustments to tax brackets, updates to credit amounts, and modifications to deduction limits. Staying informed about these changes is crucial for maximizing your refund.

Key Changes for 2025

- Increased standard deduction amounts

- Modified Child Tax Credit thresholds

- Updates to retirement account contribution limits

Planning Ahead for Future Refunds

To ensure optimal refunds in future years, consider the following strategies:

- Adjust withholding allowances to align with expected income

- Keep detailed records of deductions and credits

- Consult with a tax professional for personalized advice

Conclusion and Call to Action

IRS tax refunds 2025 offer a valuable opportunity for taxpayers to regain control of their finances. By understanding eligibility criteria, leveraging deductions and credits, and avoiding common errors, you can maximize your refund potential. Remember to stay informed about tax reforms and plan ahead for future filings.

We encourage you to share your experiences or ask questions in the comments below. Additionally, explore other articles on our site for more insights into personal finance and tax planning. Together, let's make the most of the 2025 tax season!

- Rucci Rims Price

- 2018 Chevy Trax Coolant Reservoir Hose

- Aoc Stupidity

- The Great Clown Pagliacci

- Alexandra Kuczynski

Tax Brackets 2025 Irs Selle Abigail

Are Tax Refunds Delayed In 2025 May R. Lovins

What Is The Irs Tax Refund Calendar For 2025 Isidro Tremblay